oregon workers benefit fund tax rate

The date you first became unemployed due to COVID-19. AmTrust North America is one of the fastest growing insurance companies in the comp industry.

District Court for the District of Oregon declared the DOLs 2011 regulations that limit an employers use of its employees tips when the employer has not taken a tip credit against its minimum wage obligations to be invalid and.

. How much you earned during any past week for which you are. The Oregon Employment Department and the Oregon Law Center announced two settlement agreements. Workers Comp Insurance Coverage From AmTrust.

The state income tax rate in Oregon is progressive and ranges from 475 to 99 while federal income tax rates range from 10 to 37 depending on your income. Fund administrative costs of the states workers compensation system noncomplying employer claims a portion of Oregon OSHA administrative costs and other related programs. In November 2013 the National Labor Relations Board NLRB announced that it had found that.

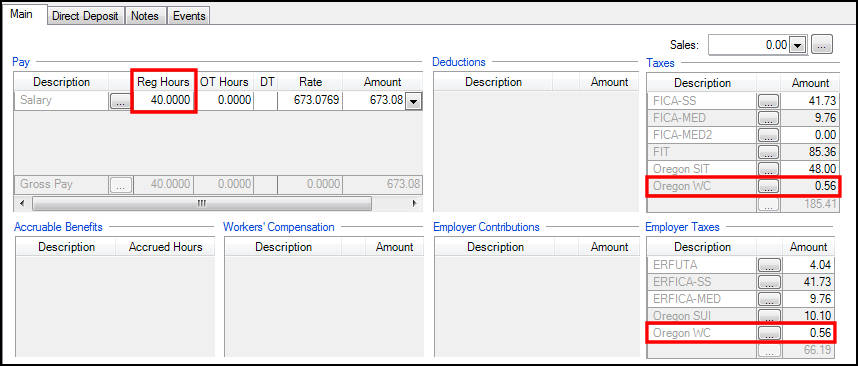

These issues involve low wages poor working conditions inadequate health care as well as issues involving the companys strong anti-union policies. Wages 2 take a full credit for the Fringe Rate for contributions to employee benefit programs eg. The Workers Benefit Fund WBF assessment This is an assessment on the payroll earned by all workers subject to Oregon workers.

Wisconsin Losing Ground to Tax-Friendly Peers. Unlike private institutions which rely more heavily on charitable donations and large endowments to help fund instruction public two- and four-year colleges rely heavily on state and local appropriations and dollars from tuition and fees. The lawsuit sought to resolve issues related to timeliness challenges and language barriers faced by Oregonians filing for.

With over 22 million employees worldwide Walmart has faced a torrent of lawsuits and issues with regards to its workforce. The state of Oregon also includes a Workers Compensation Insurance fee to help fun the Workers Benefit Fund WBF and a transit tax that goes towards the Statewide Transportation. Form 1120s AND K-1 or W-2.

See our PUA Income Documentation Guide such as. Form 1065 AND K-1 or W-2. Prevailing wage rate laws ensure local participation and community established pay standards on publicly funded projects.

In Oregon Restaurant and Lodging Assn et al. The company has grown from 526 Million in 2006 to over 41 Billion in 2014. Proof of earnings only if you want a weekly benefit amount higher than the 205 minimum.

Prevailing wage rates are the amounts that must be paid to construction workers on all public works projects in Oregon. State and local tax revenue is a major source of support for public colleges and universities. Form 1040 or 1040-RS AND Schedule C.

Three Takeaways from the New Congressional Budget Office Outlook. The first agreement follows a class action lawsuit filed by 14 Oregonians who waited weeks or months for unemployment benefits. Tax Foundation is Americas leading independent tax policy resource providing trusted nonpartisan tax data research and analysis since 1937.

US-China Trade War Hurt American Industries and Workers.

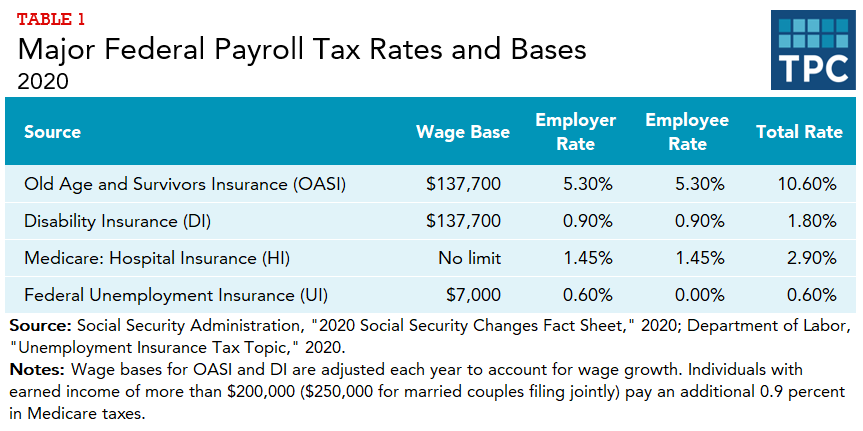

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Oregon Workers Compensation Division Do I Need Insurance Employer State Of Oregon

Oregon Workers Compensation Division Do I Need Insurance Employer State Of Oregon

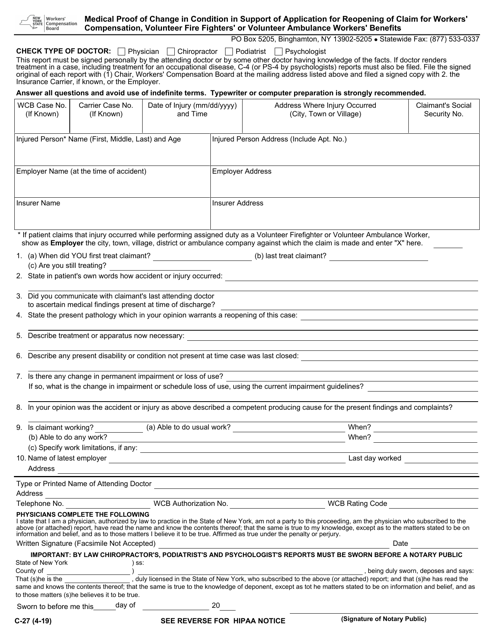

Form C 27 Download Fillable Pdf Or Fill Online Medical Proof Of Change In Condition In Support Of Application For Reopening Of Claim For Workers Compensation Volunteer Fire Fighters Or Volunteer Ambulance Workers

How Are My Workers Compensation Benefits Calculated Kbg Injury Law

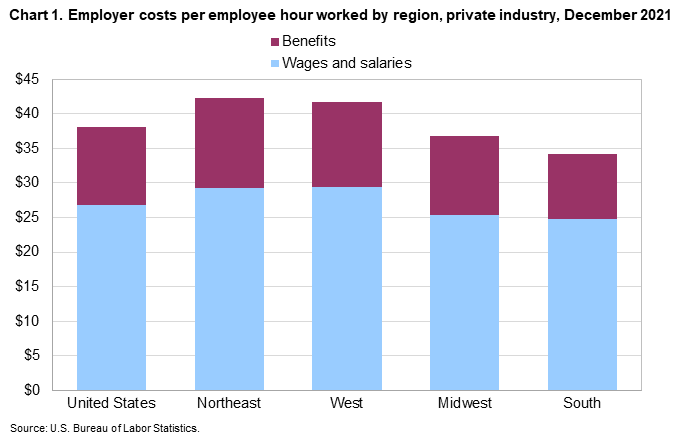

Employer Costs For Employee Compensation For The Regions December 2021 Southwest Information Office U S Bureau Of Labor Statistics

How Are Workers Compensation Benefits Calculated Foa Law

Form C 27 Download Fillable Pdf Or Fill Online Medical Proof Of Change In Condition In Support Of Application For Reopening Of Claim For Workers Compensation Volunteer Fire Fighters Or Volunteer Ambulance Workers

Oregon Workers Benefit Fund Wbf Assessment

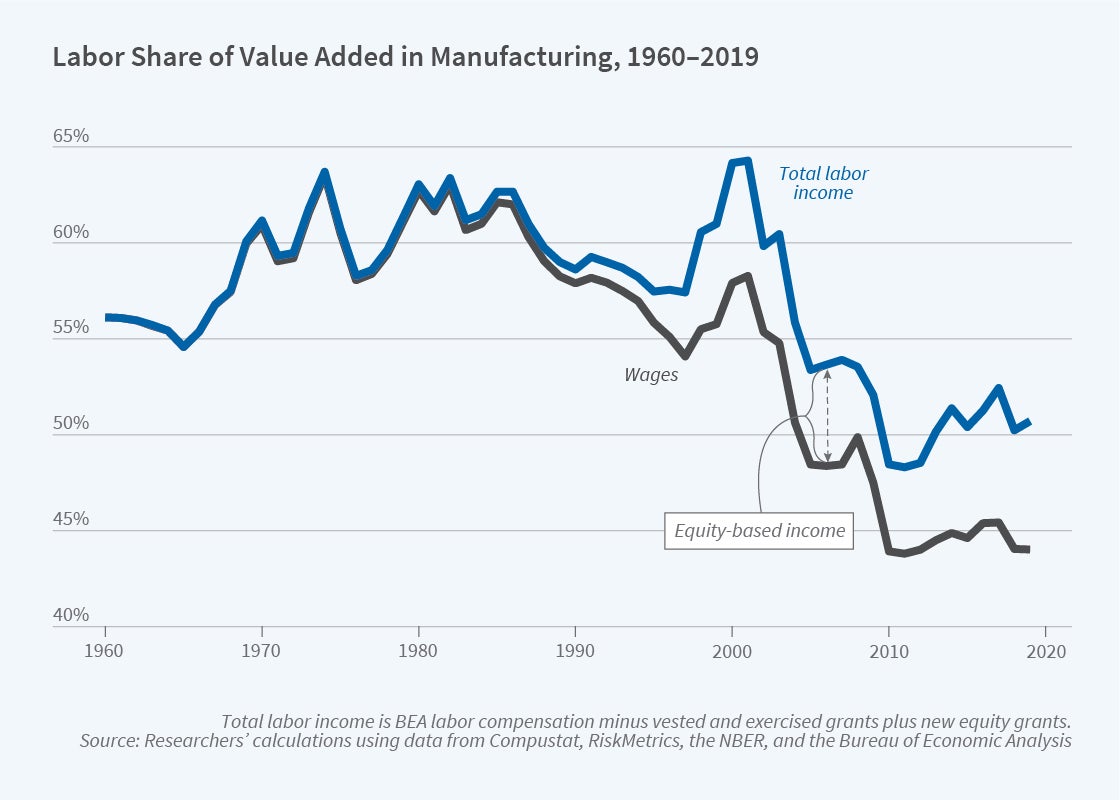

The Rise Of High Skilled Workers As Human Capitalists Nber

Pin On Legalshield Independent Associate

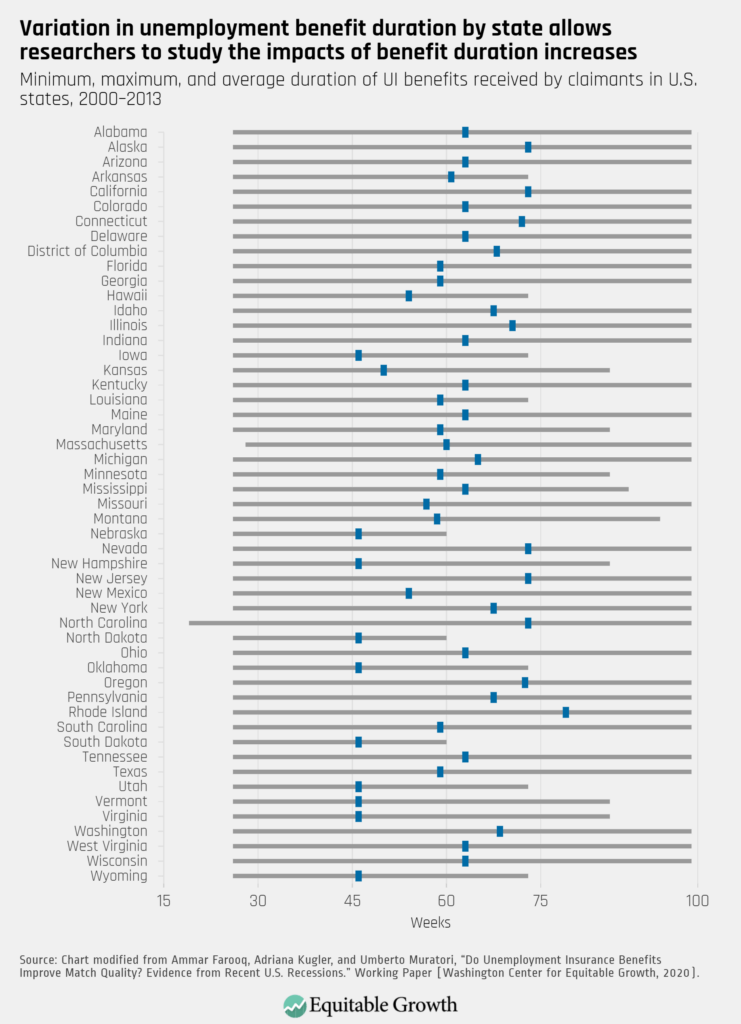

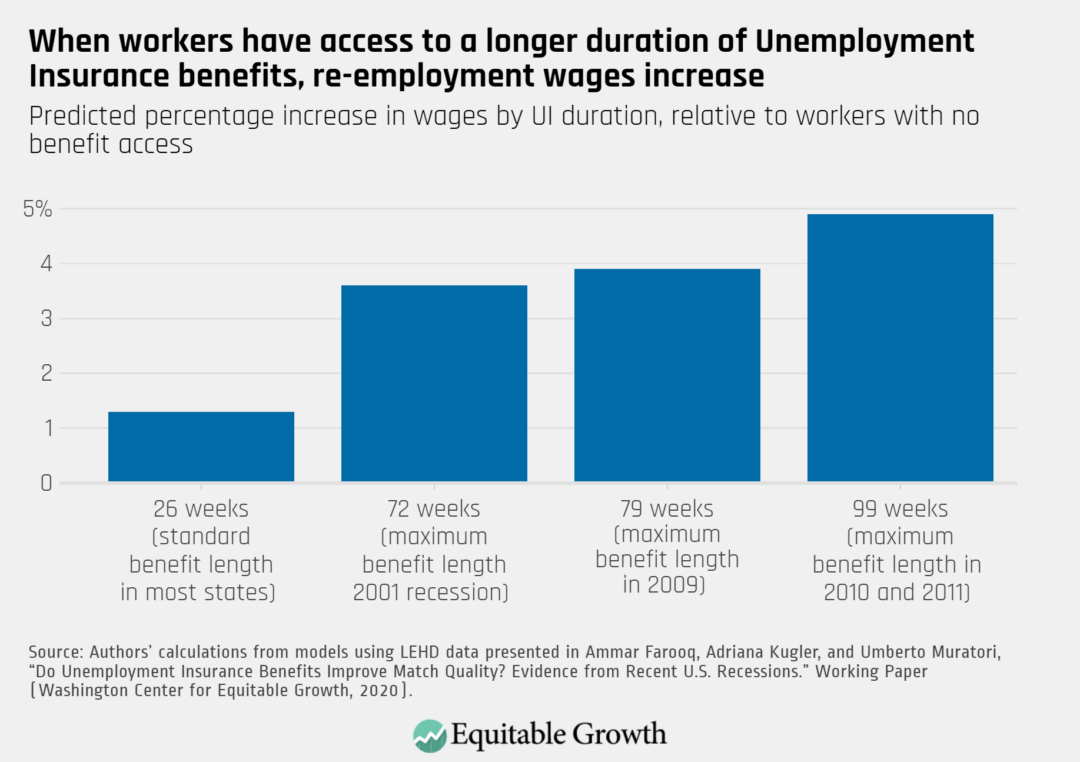

The Long Run Implications Of Extending Unemployment Benefits In The United States For Workers Firms And The Economy Equitable Growth

Future Of Work Initiative State Policy Agenda The Aspen Institute

The Long Run Implications Of Extending Unemployment Benefits In The United States For Workers Firms And The Economy Equitable Growth

Neca Ibew Of Illinois Health And Welfare Plan Benefits Administration