what is a secondary property tax levy

Certain districts levy based on acreage Numbers 5 19 such as Electrical Water and Irrigation versus valuation. Search the tax Codes and Rates for your area.

Riverhead School District Administration Proposes 170 6 Million Budget For Next Year With A 1 Tax Levy Increase Riverheadlocal

In a two-tiered municipality a component of the rate is set by the upper-tier and a component is set by the lower-tier.

/GettyImages-CA21828-a19376e37c97499799e45f8aa4940dd3.jpg)

. Property tax has two components. Secondary Tax Rates are used to fund such things as bond issues budget overrides and special district funding. State Equalization Assistance Tax - Education Assistance 520 724-8650.

Secondary Property Tax Levy debt repayment. Flagstaff Unified School District 1. The Arizona Constitution limits the total amount of primary property taxes that counties cities and community college districts can levy.

Credit reporting agencies may find the Notice of Federal Tax Lien and include it in your credit report. In that case the government will sell the property and use the earnings to pay your back taxes. Secondary Property Tax SEC.

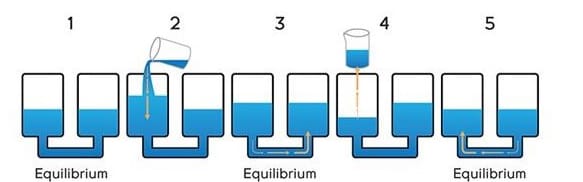

The tax levy is calculated using the formula to the right. Pinal County Property Tax mobile application for Apple and Android. View the history of Land Parcel splits.

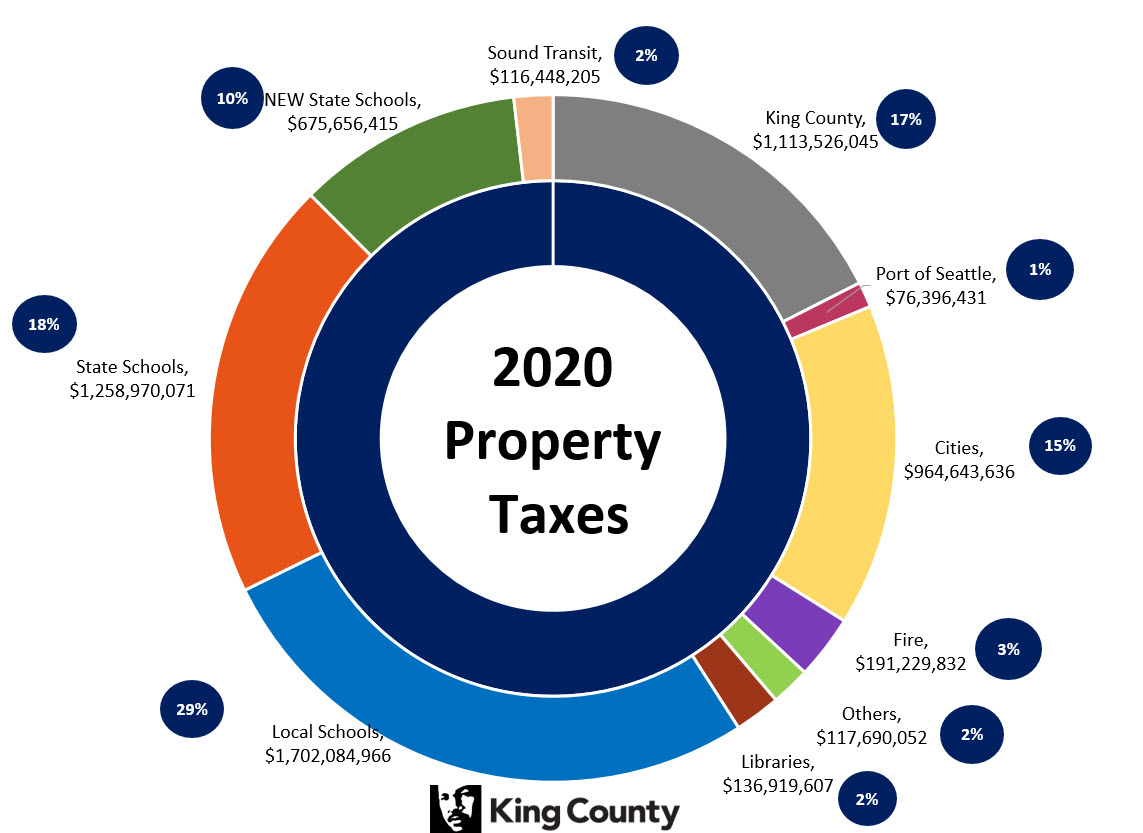

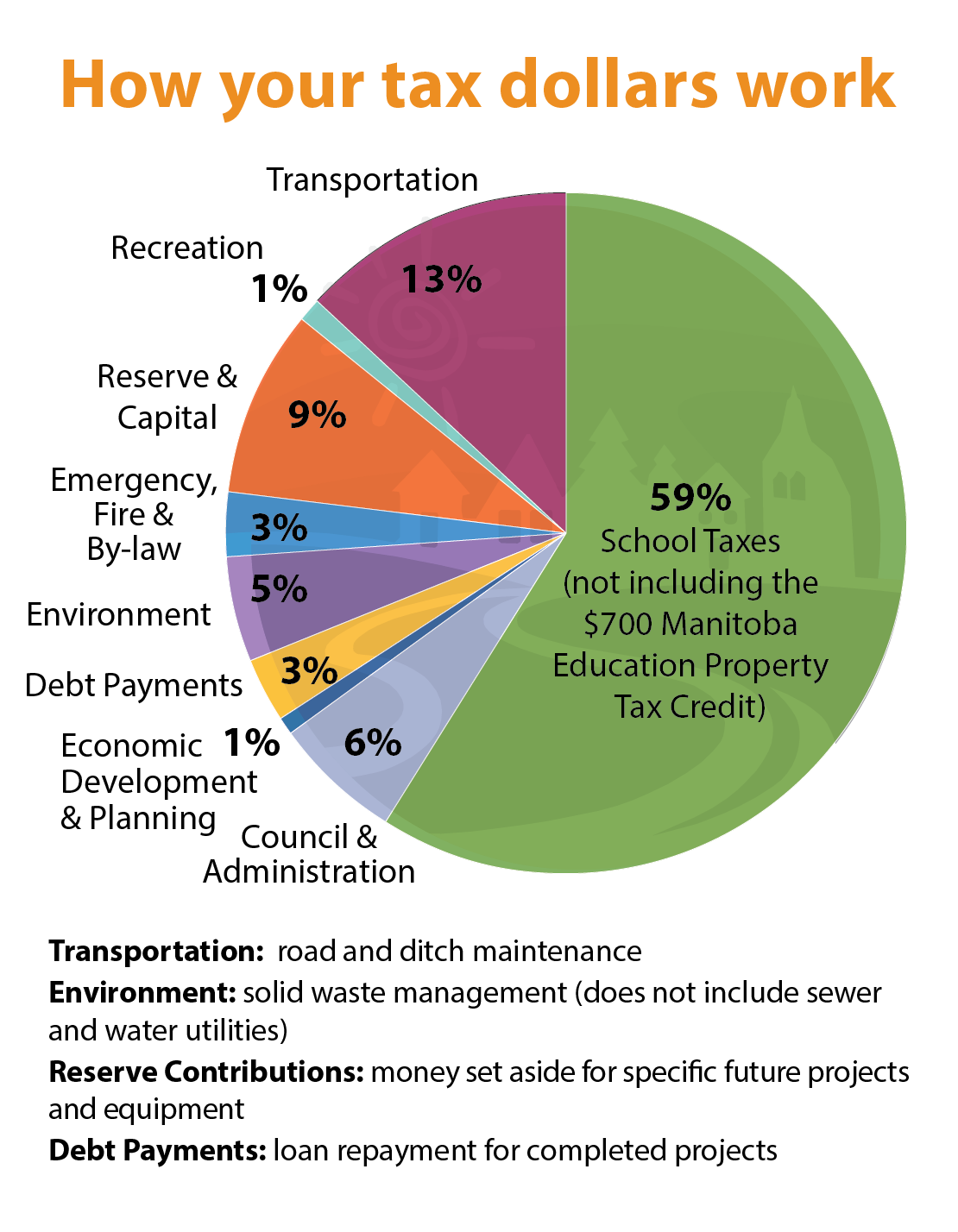

In other words the levy is the cap on the amount of property tax dollars a local government is allowed by law to collect. 14 Special District Tax. The City collects a secondary property tax which is used to pay the principal and interest due for debt associated with General Obligation bonds.

Clerk of the Board. Levies are different from liens. An IRS levy is not a public record and should not affect your credit report.

For additional questions on tax rates and CCCs budget please contact CCC at 928 527-1222. A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes the property to satisfy the tax debt. A levy is a legal seizure of your property to satisfy a tax debt.

Silverbell Irrigation Drainage District Secondary 520 251-0628. Levy Limits Homeowners Rebate Tax Deferral Exemptions. The municipal tax authority sets a percentage rate for imposing taxes called a levy rate which is then calculated against the assessed value of each homeowners property ad valorem literally.

A tax levy is a collection procedure used by the IRS and other tax authorities such as the state treasury or bank to settle a tax debt that you owe to them. The secondary tax is comprised mainly of commitments to satisfy bond indebtedness of jurisdictions fund voter-approved budget overrides and to support the operations of the special taxing districts such as fire flood control street lighting and other limited purpose districts in which your property is located. A levy is a legal seizure of your property to satisfy a tax debt.

This involves collecting assets and seizure of your property either tangible or intangible in a variety of ways. How is the tax levy determined. If you receive an IRS bill titled Final Notice of Intent to Levy and Notice of Your Right to A Hearing contact us right away.

View all options for payment of property taxes. A city or town may levy whatever amount of secondary property taxes is necessary to pay general obligation debt. Refer to number 4.

Comprised of the total of the obligation for Special Taxing Districts voter approved bonds and budget overrides that are assessed on valuation. Property taxes are levied because they are essential to the functioning of the government. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

Prior to 2019 CCC also levied a secondary property tax which was not renewed by voters. Property tax is a levy based on the assessed value of property. Coconino Community College - beginning in 2019 CCC only has a primary property tax which goes to support CCCs general operations.

The idea of a levy is that the government will take the property because you are unable to or refuse to pay what you owe on it. A tax levy is the amount specific in dollars that a taxing unit city town township etc may raise each year in property tax dollars. A municipal portion and an education portion.

The secondary tax is calculated using the Limited Value of your. 113 rows San Fernando Elementary School District 35 Secondary 520 724-8451. County Board of Equalization Process.

Tax Levy and Rates. It is different from a lien while a lien makes a claim to your assets as security for a tax debt the levy takes your property such as funds from a bank account Social Security benefits wages your car or your home. Tax Levy 2021 PDF Tax Levy 2020 PDF Tax Levy 2019 PDF Tax Levy 2018 PDF Tax Levy 2017 PDF Tax Levy 2016 PDF Tax Levy 2015 PDF Tax Levy 2014 PDF.

The City uses the tax levy not the tax rate to manage the secondary property tax. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. Under state law cities and towns are allowed to levy a secondary property tax for the sole purpose of retiring the principal and interest on general obligation bonded indebtedness.

If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. Divide that 20000 by 100 per 100 assessed value results in 200 which is then multiplied by the tax rate to get 198 in secondary property tax owed to the town. It can garnish wages take money in your bank or other financial account seize and sell your vehicles real estate and other personal property.

The rates for the municipal portion of the tax are established by each municipality.

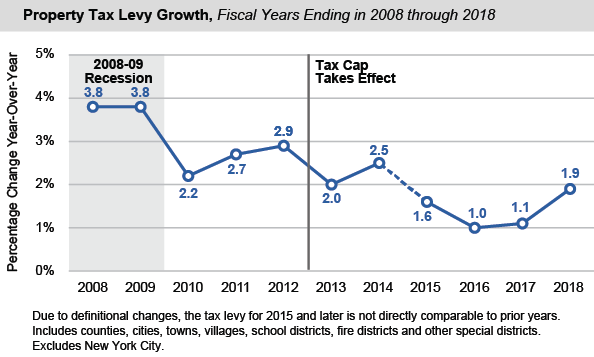

Local Government Office Of The New York State Comptroller

/GettyImages-CA21828-a19376e37c97499799e45f8aa4940dd3.jpg)

Tax Lien Certificate Definition

Property Assessments City Of Port Coquitlam

Property Tax Rates City Of Penticton

Property Taxes The Town Of Okotoks

Property Tax Info Rural Municipality Of St Clements

Statutory Valuation Cycles And Current Property Assessment For Rating Download Table